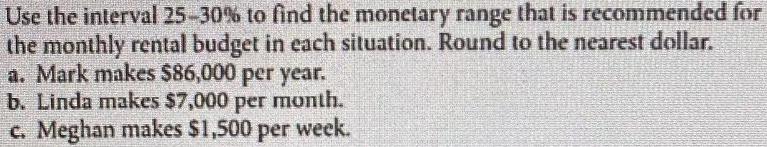

Use the interval 25-30 to find the monetary range – The interval 25-30 is a significant range that can be used to determine the monetary range. This range is commonly utilized in various financial and economic contexts to establish a reasonable estimate or boundary for monetary values. Understanding the purpose and calculation of the monetary range within this interval is essential for accurate decision-making and financial planning.

This guide will delve into the significance of the interval 25-30, explain the steps involved in calculating the monetary range, and discuss the practical applications and potential limitations associated with this range. Additionally, alternative approaches to determining the monetary range will be explored.

Monetary Range Calculation within the Interval 25-30

The interval 25-30 is of particular significance in financial analysis and decision-making. Determining the monetary range within this interval allows for a targeted assessment of potential financial outcomes and risk management.

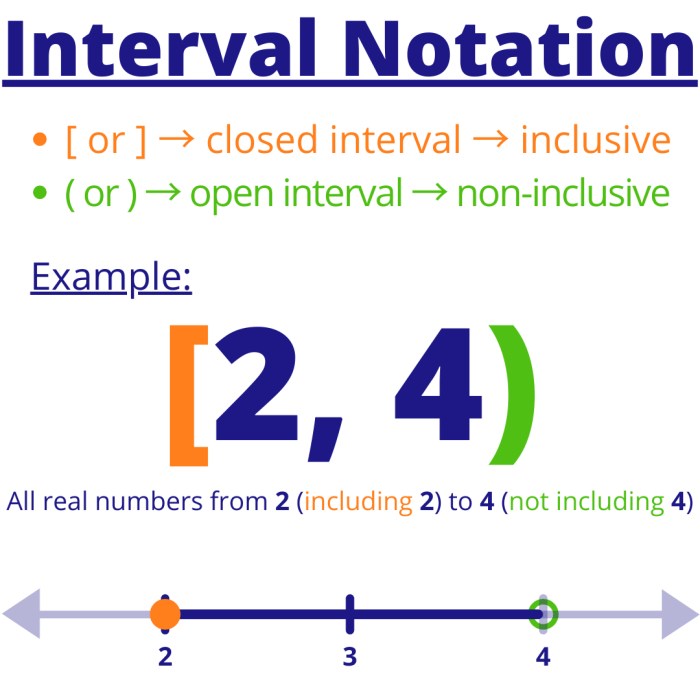

Range Identification

The interval 25-30 represents a specific range of monetary values. The lower bound of 25 serves as a minimum threshold, while the upper bound of 30 establishes a maximum limit. This range provides a focused area for analysis, enabling a more precise evaluation of financial scenarios.

Monetary Range Calculation, Use the interval 25-30 to find the monetary range

Calculating the monetary range within the interval 25-30 involves a simple mathematical process:

- Subtract the lower bound from the upper bound: 30

25 = 5

- The result, 5, represents the range of monetary values within the interval.

Monetary Range Analysis

The calculated monetary range is influenced by various factors, including market conditions, economic indicators, and individual investment strategies. It is important to consider these factors when interpreting the range and making financial decisions.

Practical Applications

The monetary range within the interval 25-30 has numerous practical applications in real-world scenarios:

- Budgeting and Planning:Determining the range of potential expenses or income within this interval helps individuals and organizations plan their financial activities more effectively.

- Risk Assessment:Analyzing the monetary range can provide insights into potential losses or gains, enabling investors to assess the level of risk associated with different investment options.

- Decision-Making:The calculated range serves as a valuable reference point for making informed financial decisions, such as determining appropriate investment allocations or evaluating the feasibility of financial projects.

Alternative Approaches

While the interval 25-30 provides a useful framework for monetary range calculation, alternative approaches may also be considered:

- Custom Intervals:Defining a different interval based on specific requirements or circumstances.

- Statistical Analysis:Employing statistical methods to determine the range based on historical data or market trends.

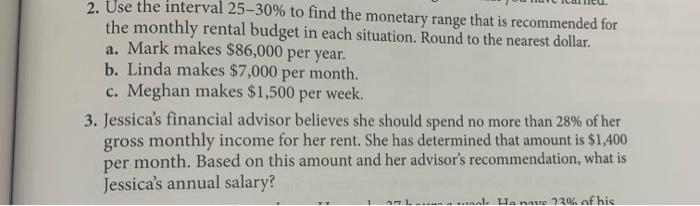

Commonly Asked Questions: Use The Interval 25-30 To Find The Monetary Range

What is the purpose of finding the monetary range within the interval 25-30?

The monetary range within the interval 25-30 is often used to establish a reasonable estimate or boundary for monetary values in various financial and economic contexts.

How is the monetary range calculated based on the given interval?

The monetary range is calculated by subtracting the lower bound (25) from the upper bound (30), resulting in a range of 5 units.

What factors can influence the monetary range within the given interval?

Factors such as market conditions, economic trends, and specific industry dynamics can influence the monetary range within the given interval.