Calculating your net worth worksheet answers – Unveiling the intricacies of calculating your net worth, this guide delves into the essential components, empowering you with the knowledge to assess your financial well-being and make informed decisions.

By understanding the concepts behind net worth and its significance, individuals can gain valuable insights into their financial situation and embark on a path towards financial growth.

Understanding Net Worth Worksheet: Calculating Your Net Worth Worksheet Answers

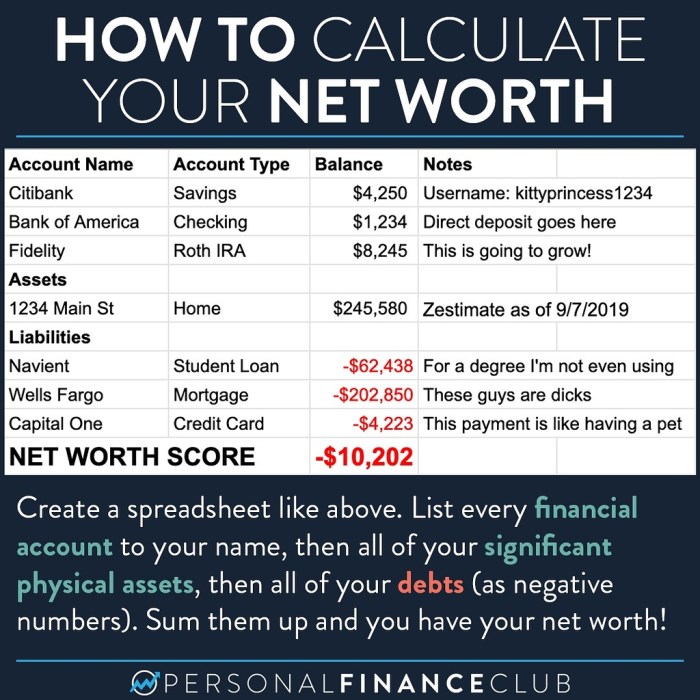

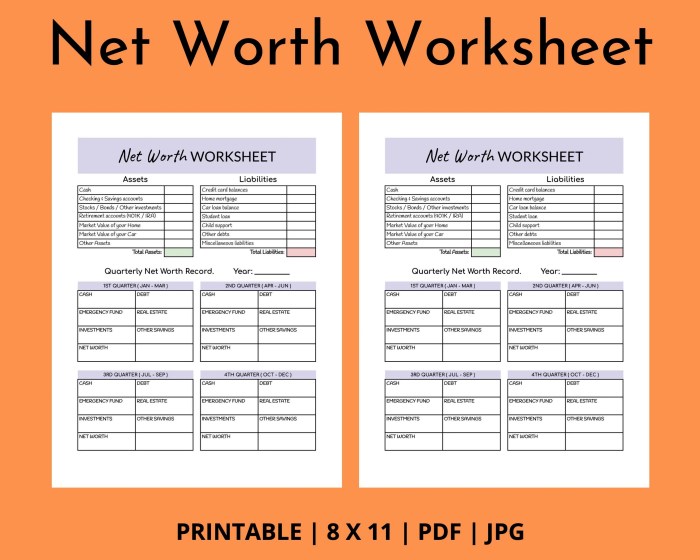

A net worth worksheet is a financial tool that provides a snapshot of an individual’s financial health. It helps individuals track their assets and liabilities, and calculate their net worth, which is the difference between their assets and liabilities.

The components included in a net worth worksheet typically include:

- Assets: Cash, investments, property, vehicles, and other valuable possessions.

- Liabilities: Mortgages, credit card balances, loans, and other debts.

Assets Section

The assets section of a net worth worksheet includes a table with columns for different asset categories. Individuals should list all relevant assets and their estimated values in the corresponding columns.

| Asset Category | Value |

|---|---|

| Cash | $10,000 |

| Investments | $50,000 |

| Property | $200,000 |

Liabilities Section

The liabilities section of a net worth worksheet also includes a table with columns for different liability categories. Individuals should list all outstanding liabilities and their balances in the corresponding columns.

| Liability Category | Balance |

|---|---|

| Mortgage | $150,000 |

| Credit Cards | $5,000 |

| Loans | $20,000 |

Net Worth Calculation, Calculating your net worth worksheet answers

Net worth is calculated by subtracting total liabilities from total assets. The formula is:

Net Worth = Assets

Liabilities

For example, if an individual has $250,000 in assets and $175,000 in liabilities, their net worth would be $75,000.

Interpreting Results

A high net worth indicates financial stability and wealth. It can provide individuals with financial security and flexibility. A low net worth, on the other hand, may indicate financial stress or a need for improved financial management.

Net worth can be used for financial planning purposes. Individuals can use it to set financial goals, track progress, and make informed decisions about investments, savings, and debt management.

Tips for Improving Net Worth

- Increase assets: Invest in stocks, bonds, real estate, or other income-generating assets.

- Reduce liabilities: Pay down high-interest debts, such as credit cards and loans.

- Adopt financial habits that contribute to net worth growth, such as budgeting, saving, and investing.

Helpful Answers

What is the purpose of calculating net worth?

Calculating net worth provides a clear picture of your financial health by summarizing your assets and liabilities, helping you make informed financial decisions.

How often should I calculate my net worth?

It is recommended to calculate your net worth at least annually, or more frequently if you experience significant financial changes.

What are some strategies for increasing net worth?

Strategies for increasing net worth include increasing income, reducing expenses, investing wisely, and managing debt effectively.